Who Pays America’s Highest (and Lowest) Property Taxes?

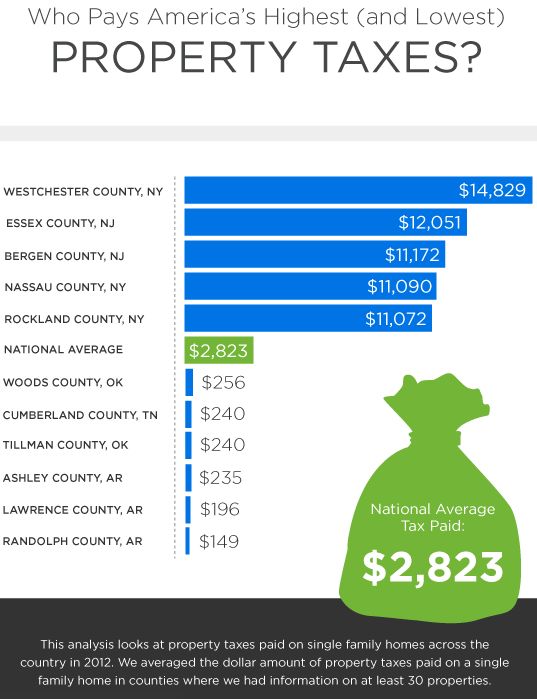

The second biggest cost of home ownership—following the mortgage—is usually property taxes. In 2012, U.S. homeowners paid an average of about $2,800 in property taxes, according to a recent Zillow study. And if you live in New York, New Jersey, or Colorado your taxes were in some cases five times more than the national average. The numbers are based on an average of real estate taxes paid on single family housing in 2012.

The residents of Westchester County in New York pay more in property taxes than the typical resident of any other major American county. The average property tax bill for a single family home in Westchester County comes to $14,829 a year.

Highest Property Taxes as a Percent of Home Value

Allegany County, N.Y. (3.76 percent)

Milwaukee County, Wis. (3.68 percent)

Kendall County, Ill. (3.57 percent)

Sullivan County, N.Y. (3.56 percent)

Orleans County, N.Y. (3.49 percent)Lowest Property Taxes as a Percent of Home Value

Caroline County, Va.( 0.17 percent)

Catahoula County, La. and Randolph Ariz, (0.2 percent)

Iberville County, La. and Cumberland County, Tenn. (0.21 percent)

Butler County, Penn. and Maui County, Hawaii (0.22 percent)

Elmore County, Ala. and De Soto County, La. (0.23 percent)

For the complete article, click here.

If you want to know the property tax rates in the Lake Norman area send me an email or contact me at the number below.

Janet Shawgo

Realtor®/Broker

The Lake Norman Homes Team

Southern Homes of The Carolinas

www.LakeNormanNCRealEstate.com

704-657-0838

Leave a Reply

You must be logged in to post a comment.